Solvency (1) - Quick Ratio

|

Solvency (2) - Current Ratio

|

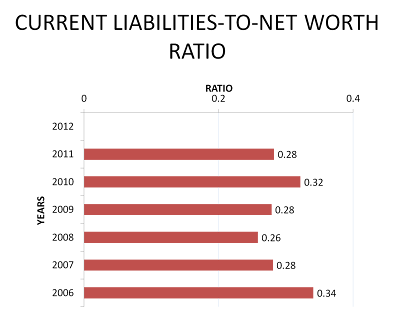

Solvency (3) - Current Liabilities to Net Worth Ratio

|

Solvency (4) - Total Liabilities to Net Worth Ratio

|

Solvency (5) - Fixed Assets to Net Worth Ratio

|

Efficiency (1) - Collection Period Ratio

|

Efficiency (2) - Net Sales to Inventory Ratio

|

Efficiency (3) - Assets to Net Sales Ratio

|

Efficiency (4) - Assets to Net Working Capital

|

Efficiency (5) - Payable to Net Sales Ratio

|

Profitability (1) - Return on Sales, or Profit Margin

|

Profitability (2) - Return on Assets

|

Profitability (3) - Return on Equity

|

No comments:

Post a Comment